Share Trading Account Management Solutions.

For high-net-worth, corporate and institutional clients, our dedicated dealing team can help you open a trading account on Bursa Malaysia and execute your trades at attractive brokerage rates. We also provide targeted primary access to IPOs and selective secondary share placements for stocks listed on Bursa Malaysia.

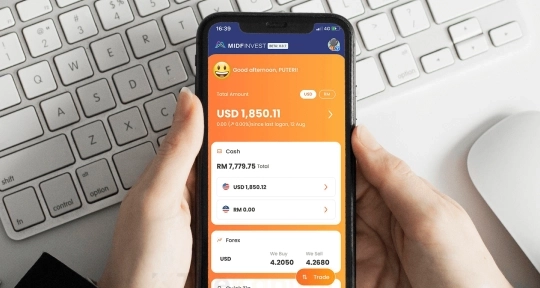

For retail clients, you can trade stocks and ETFs listed on the New York Stock Exchange and Nasdaq via MIDF Invest. You also have the choice to open an Islamic trading account and invest in a sizable universe of Shariah-compliant US shares and ETFs.

Frequently Asked Questions.

What is share investing?

Share investing involves buying and selling of publicly traded companies shares. Typically, these companies are listed on Bursa Malaysia (BM).

When someone buys a share in any publicly traded company, it means that they are now a small part-owner of the company and will also stake some claim on their assets and earnings.

The difference between share trading and share investing is that while share trading is done with short term goals in mind, share investing is typically done for the long term.

What are the different types of share trading?

In share trading, there are three main types;

- Short-term share trading, where the investor typically buys and flips the stocks over a brief period of time, such as days, weeks, or months. The goal of short-term share trading is to make quick profits by taking advantage of market fluctuations.

- Long term share trading is the opposite of short-term share trading, where the investor holds on to his/her stocks for a long period of time, even decades depending on the investor’s needs. Long-term share traders are more typically known as share investors instead of traders.

- Ultra-short term share trading. As the name suggests, this is an extreme version of short-term share trading, where the investors use algorithms to help them place trades in milliseconds, to make a string of small but really quick profits.

Who can open a trading account in Malaysia?

In order to trade on Bursa Malaysia, an investor must open a Central Depository System (CDS) account. A CDS account application is open for anyone who meets any of the following criteria;

- An individual who has reached the age of eighteen (18) years as of the application date;

- A corporation within the context of Section 3 of the Companies Act 2016 including a limited liability partnership within the meaning of Section 2 of the Limited Liability Partnerships Act 2012;

- Any corporate body that is incorporated within Malaysia and is by notice published in the Gazette, declared as a public authority or an instrumentality or agency of the Government of Malaysia or of any Malaysian State;

- A society under any written law relating to cooperative societies;

- A trustee or trust corporation duly constituted under any written law;

- Statutory bodies incorporated under an Act of Parliament.

- Any society registered under the Societies Act 1966

How to register a trading account in Malaysia?

Any person who meets the requirements of opening a CDS account can register their CDS account through any Authorised Depository Agents (“ADAs”). All stockbroking companies in Malaysia are currently ADAs. You may locate the contact details of the head offices of all ADAs/stockbroking companies via the Bursa Malaysia website.

What is the difference between stocks and shares?

The easiest way to explain the difference between stocks and shares is by determining what it is measuring. A stock is a measurement of equity, which means how many stocks you own is how much equity you have with the company.

Meanwhile, a share is a unit of ownership in the company.